SAM Magazine—Natick, Mass., Jan. 7, 2026—Resorts are investing more in technology and increasingly treating it as a strategic priority, according to SAM’s 2025–26 Technology Survey. Respondents indicated the next wave of investment is focused on system integration, guest-facing services, and using data to inform operational and revenue decisions, even as cost and vendor constraints persist.

Respondents indicated the next wave of investment is focused on system integration, guest-facing services, and using data to inform operational and revenue decisions, even as cost and vendor constraints persist.

SAM collected responses from 75 resort professionals across North America who hail from a diverse mix of ski area sizes and geographical locations, plus one from Australia. Results were aggregated and reported anonymously.

This is an executive summary of the results. An upcoming report in a supplement to the March 2026 issue of SAM will expand on these findings with deeper analysis, more detailed breakouts, and additional context from the qualitative comments. Among the key takeaways:

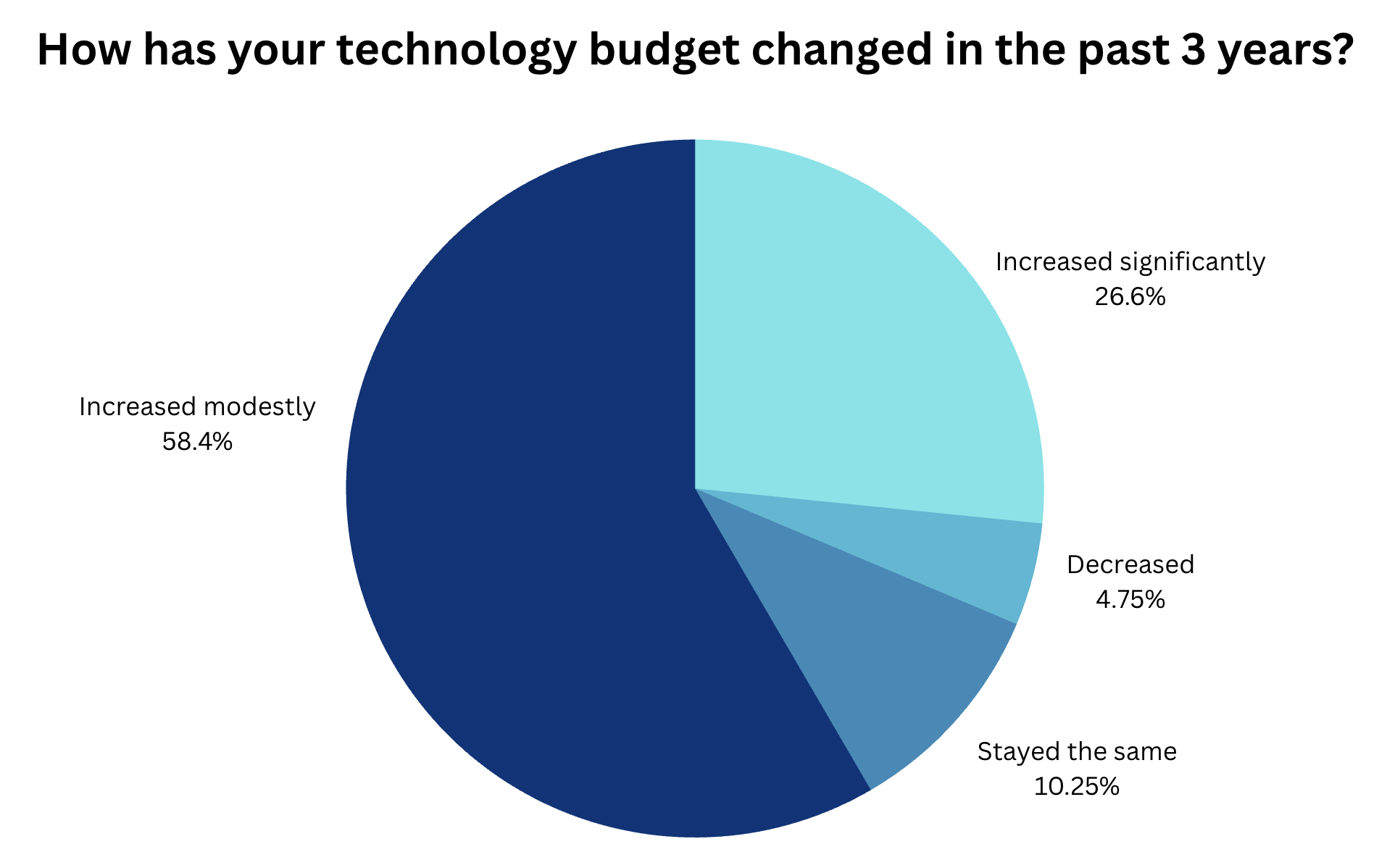

- 85% of respondents reported their tech budgets have increased in the past three years.

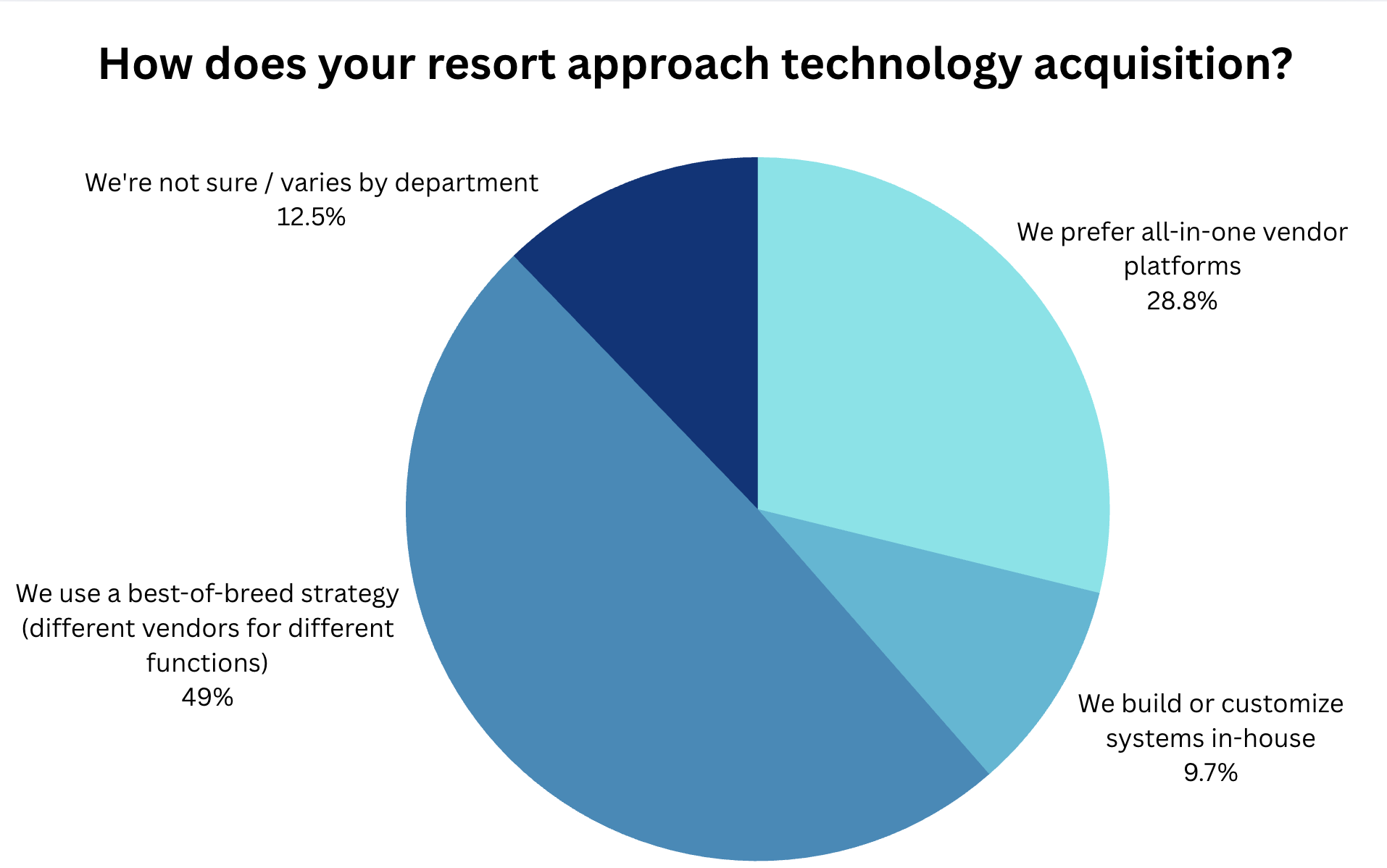

- Best-of-breed is the leading national strategy (49%), but it skews by size with 73% of large/extra-large resorts using a best-of-breed tech stack compared to 33% of small resorts.

- Cloud-based systems are common nationally (51%), with a pronounced size split: 71% of small resorts are primarily or fully cloud-native compared to 31% of large/extra-large resorts.

- 37% of respondents said they’re already using AI tools, with higher reported usage among larger resorts (48%) than small resorts (19%).

- IT capacity is lean: 51% of respondents reported having 2–5 dedicated IT staff, with small resorts far more likely to operate with 0–1.

At the national level, the results point to the increasing strategic significance of tech investment, with 64% of respondents rating the importance of technology to their organization 4-5 on a 5-point scale. Still, cost was often cited as a restraint in the qualitative comments, as were vendor limitations and the day-to-day complexity of getting systems to work together.

Resorts’ top priorities for future investments speak to those challenges, with 54% of respondents prioritizing integration and data flow, 52% guest experience modernization, and 42% dashboards and analytics. When it comes to existing measurable improvements at resorts, RFID/access control and e-commerce/online sales were the most-cited technology investments.

There are some interesting variations in the trends when the results are segmented by size. For example, small resorts believe future technology investments should prioritize data analytics (50%) over integrations (38%), while extra-large resorts place a much higher premium on future investment in integrations and data flow (86%), consistent with the greater tendency of extra-large and large resorts to adopt best-of-breed stacks. Large- and medium-sized resorts are in agreement that guest mobile and self-service technology should be a priority (69% and 65%, respectively) with integrations an equal or second priority.

In the full March 2026 report, we’ll look closer at how resort size shapes technology strategy and data maturity, what respondents said is slowing digital adoption, where they’re gaining measurable wins, and how they see AI evolving.

Thank you to the participating resorts and respondents for their data and insights. We are also indebted to a group of ski area tech experts for helping us fine-tune the survey and assess the aggregated and anonymized results. Analysis of quantitative findings and open-ended comments was supported by an AI tool developed by Eternity. As with any survey, some questions have a small number of non-responses, and size-based comparisons should be read as directional when subgroup bases are modest.