Summer operations offer ski areas many benefits, including a reduced reliance on winter revenues, year-round employment for more staff, an introduction to non-winter sports enthusiasts, resilience against climate change, and absorption of overhead. It takes a careful, strategic approach to take full advantage of these benefits, though.

Summer operations at winter resorts have grown significantly over the past decade. According to the National Ski Areas Association’s 2023-24 Economic Analysis of U.S. Ski Areas, 109 ski areas operated in summer 2023, up from 84 in 2014, with average revenue per area rising 71 percent, from $3.8 million to $6.4 million. However, revenue has stagnated over the last three years, and declined 9 percent from the Covid-bump summer of 2022.

This article supplements the Economic Analysis data with feedback from Guest Research’s ski clients’ summer 2024 visitors, comparing summer and winter visitor metrics to explore summer’s growth potential. It reveals both positive and challenging insights.

The Good News About Summer

According to the Economic Analysis, 54 percent of summer 2023 revenue came from existing facilities that support winter operations—namely lodging, food & beverage, groups/weddings/conferences, retail, and rentals—rather than those dedicated to summer business. Additional income came from mountain-based activities like scenic chairlift/gondola rides, mountain biking, and alpine slides/mountain coasters.

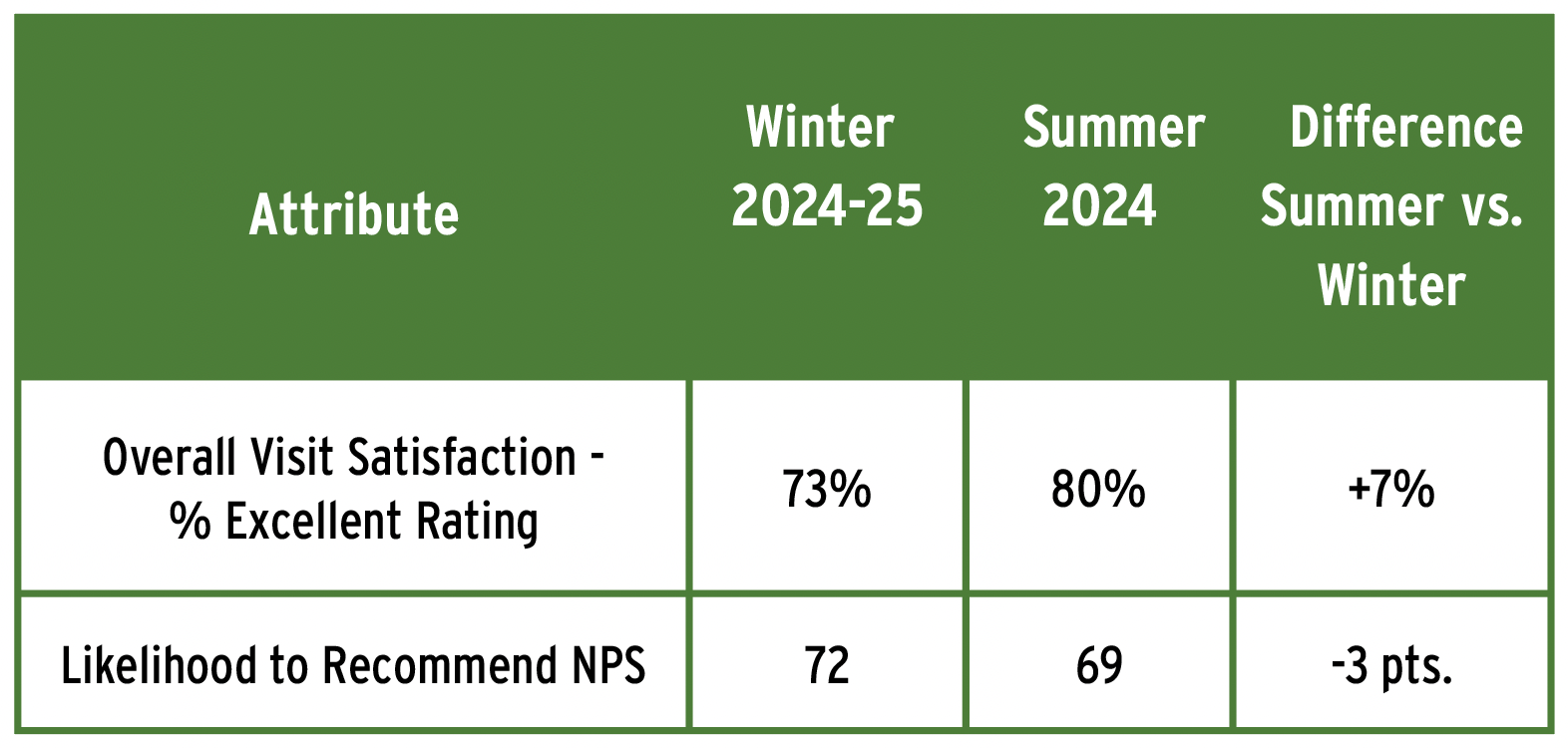

And summer visitors have a great time at winter resorts. As shown below, summer visitors reported higher satisfaction (80 percent “Excellent” rating) than winter visitors (73 percent), with a Likelihood to Recommend Net Promoter Score (NPS) nearly as high as winter’s (69 vs. 72).

So why isn’t summer revenue growing? Let’s look deeper into the visitor feedback.

The Challenges of Growing Summer

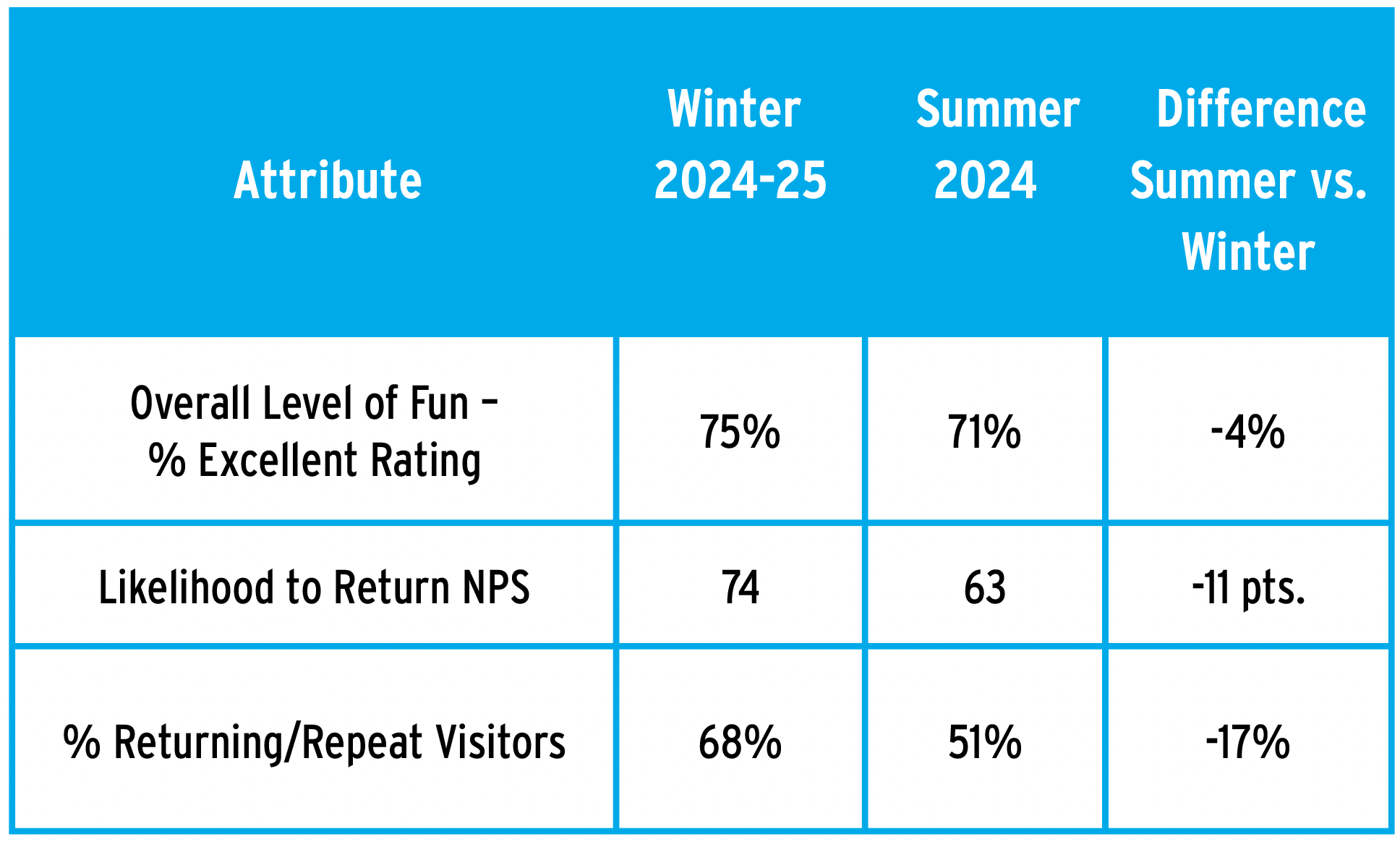

Tellingly, summer visitors say they experience a lower “Level of Fun.” This is important, because Fun is highly correlated with both the Likelihood to Recommend and Overall Visit Satisfaction. While 75 percent of winter visitors rated their Level of Fun as “Excellent,” a smaller portion of summer visitors—71 percent—said their Level of Fun was “Excellent.”

While that’s not a major difference, additional comparisons of summer to winter data are more revealing. Summer visitors’ Likelihood to Return Net Promoter Score (NPS) was 63, sharply lower than the 74 for winter visitors. And actual visitor behavior is even more convincing: returning summer guests represented one-half of all visitors in 2024, 17 percentage points less than during winter.

In sum, summer visitors are highly satisfied and recommend the ski area to others, but they are not as satisfied or motivated to return, or return more frequently, as winter guests are. Why is this?

Why Summer Is Less “Sticky”

One answer is that there is simply a lot more competition in summer.

Another reason may be that the summer activities, events, and facilities are not sufficiently sticky anchor activities—there isn’t the same depth of passion for most summer offerings as there is for skiing and riding. An activity such as a chairlift/gondola scenic ride might be very popular, but it may also be a one-and-done endeavor.

How can summer offerings be strengthened? One way is to add additional activities. A second way is to replace any activities that have limited appeal with others that have stronger appeal and are more fun. Either way, we at Guest Research believe the focus should be on offering more activities and events that visitors will return to enjoy time and time again, and not just one-and-done activities.

SAM’s “The State of Summer Operations” report, published in a supplement to the January 2025 issue, indicated that 38 percent of the North American ski areas surveyed planned to remove one or more activities in the next two years. Eighty-six percent of surveyed ski areas planned to add activities to their summer operation in the next two years.

Once one or more potential new summer activities and/or events are identified, and before any final investment decision is made, it is important to compare their estimated ROI—including employee retention potential, climate change resilience, and introduction to new customers—and the strategic advantage of growing summer against the ROI of alternative investments and strategic advantage of strengthening winter.

Identifying Strong Summer Activities

Here are specific research-oriented steps you can take to pinpoint valuable summer activities:

1. Define the audiences you want to target with additional and/or more return-oriented recreational offerings, for example:

locals vs. vacationers

day visitors vs. overnight lodging guests

leisure recreation vs. sport

single adults vs. families vs. empty nesters

2. Consider the low-hanging fruit. Ask yourself:

Are there any existing activities that can be modified to increase their appeal (e.g., converting tennis courts into hybrid tennis and pickleball courts)?

Are there existing offerings that are already strong demand generators that could be expanded? To help identify these, look at how the usage and satisfaction of each of your activities correlates with key survey attributes, including Likelihood to Return, Level of Fun, Likelihood to Recommend, and Overall Visit Experience.

3. Gather customer input. Simple ways to do this include:

Adding two dropdown, open-ended questions to your summer survey. Ask respondents with a low Likelihood to Return the reasons for their rating. Also ask if there are other activities they would like added.

Asking your guests which of your current activities and events attracted them to your ski area. Cross-tabulate the responses by first-time and returning visitor.

4. Concept test potential new activities with your current and past guests. Do they find them exciting enough to return?

5. Reach out to other ski areas with summer operations to determine what their most popular activities are.

6. Talk to suppliers (including amusement park vendors) to determine which activities are strong demand generators and are likely to spur return visits. You might even attend a trade show, such as the International Association of Amusement Parks and Attractions (IAAPA) Expo, to generate ideas.

7. Keep your activities fresh. Consider the amusement park strategy of introducing something new every other year or so, be it a promotion, an event, or a new activity.

Summer activities may never generate the same level of passion and commitment as skiing and snowboarding. But summer business can nonetheless be a major source of revenue and contribute to the year-round success of winter resorts if operators provide an engaging and fun mix of things for guests to enjoy.

Another Consideration

In adding to or varying your activity mix, another element to consider is how you can maximize the impact of your resort’s existing attributes. SAM explored this idea in the May 2025 story “The Wisdom of Whistler Blackcomb.”

As the Whistler article suggests, there are ways for resorts to emphasize and enhance their natural qualities and characteristics such that some activities typically considered one-and-done, like scenic chairlift rides, can become repeat attractions if properly supported.

“Most resorts have lifts that get you to a pretty cool place, but how do you turn that cool place into something that’s way more powerful?” asked former Whistler Blackcomb VP of business development Rob McSkimming. There are a variety of answers—well-designed hiking trails, viewpoints and sightseeing structures, engaging interpretive signs, etc.—but they all come down to the development of an intentional summer-guest experience.

To bring guests back, summer at a mountain resort must feel like more than “skiing lite,” advised former Whistler Blackcomb mountain planning director Arthur De Jong. Words of wisdom to keep in mind as you look for ways to make your summer guests more likely to return.

Head to saminfo.com/summer-ops to read “The Wisdom of Whistler Blackcomb,” in which McSkimming, De Jong, and current Whistler Blackcomb leadership share additional insights on optimizing summer ops.

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld. Net Promoter Score and Net Promoter System are service marks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld.