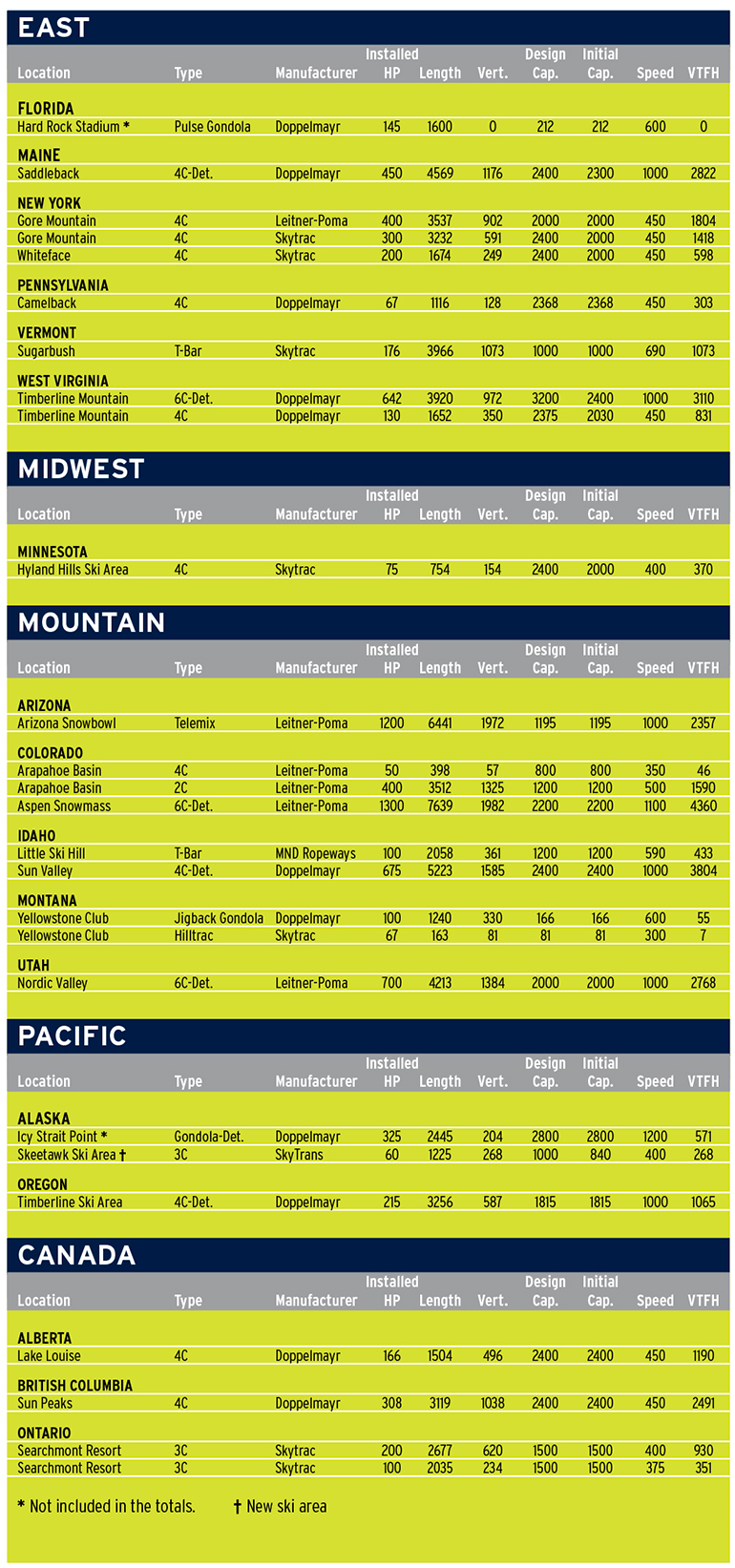

When ski resorts were forced to shut down last March, many had only recently committed to building new lifts during the summer of 2020. Others were still considering projects when they abruptly pivoted to survival mode. The result: What had been shaping up as a big year for lifts turned into something less than that.

Major postponements. Alterra Mountain Company, for example, unveiled a $223 million capital improvement plan on March 10, only to announce four days later a shutdown of its entire resort network. Within weeks, Alterra’s leaders decided to postpone planned lift projects—the same decision reached at Vail Resorts and Boyne Resorts. Vail pushed back a total of seven lift projects across five mountains, and Boyne paused two bubble chairlift projects on opposite sides of the country. With Powdr resorts also not adding any lifts in 2020, the four largest North American operators ended up adding no lifts at their 70-plus mountains.

The postponements were not only due to uncertainty about future business but also concerns about tight construction schedules and global supply chains amid lockdowns and quarantines.

“The big guys obviously had to be careful with their capital expenditures,” notes Carl Skylling, president at Skytrac Lifts in Salt Lake City.

Ups and downs. The result was the number of aerial lifts installed falling 43 percent from 2019, with vertical transport feet per hour (VTFH) down 31 percent. Even so, the number of new lifts, 24, and the VTFH were similar to those from the first half of the 2010s. Smaller and independent areas in particular proved that lift replacements and additions could happen during a pandemic.

“I think in general, larger companies and corporations have more structured decision-making processes and different risk tolerances,” says Katharina Schmitz, president at Doppelmayr USA. “Smaller businesses have a bit more flexibility when it comes to making those decisions.”

“We had a couple projects pulled back but then a couple others popped up, so we managed to stay pretty busy and close to full capacity,” notes Skylling, whose engineering and administrative teams have been working from home since March.

Leitner-Poma of America shut down manufacturing for four weeks but continued paying employees, and has not laid off anyone to date, according to senior sales manager Jon Mauch. “When Covid hit, our company was ready for it. I’m as capable here at my home as I am sitting at my desk at the factory.” Leitner-Poma ended up storing a large amount of equipment from postponed projects and then restarted production of lifts that remained on schedule.

“It really seems like there were two different schools of thought,” notes Mauch. “One is, ‘We’re in a pandemic, we don’t know what our business is going to look like, so we really need to protect our capital.’ Then there’s another group sitting there saying, ‘Hey, when we get through this, we’re going to need to have a big splash. We’re going to need something to bring business back.’”

BRIGHT SPOTS

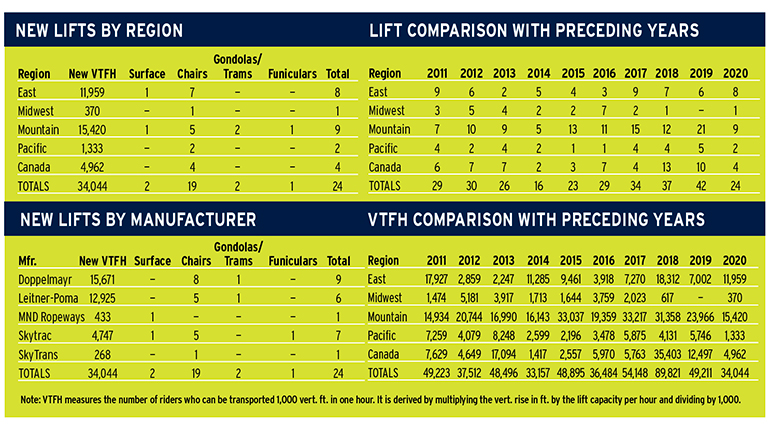

Who went big? Mountain Capital Partners and Leitner-Poma teamed up to construct two of the season’s largest lifts—a base-to-summit telemix (combination of six-passenger chairs and eight-passenger gondolas) at Arizona Snowbowl, and a six-place detachable at Nordic Valley, Utah.

The Arizona telemix became the fourth new lift built at Snowbowl over the past six years. Two chairs alternate between each gondola cabin, giving guests options in both winter and summer.

Resort revivals. Two resorts added detachable lifts after being closed for multiple seasons and taken over by new owners. A rebuild of Timberline Mountain, W.Va., included two Doppelmayr chairlifts and a carpet from Star Lifts. Further north, a Boston-based impact investment group purchased a much-needed Doppelmayr detachable quad for Saddleback, Maine’s grand reopening. More lifts and other upgrades are planned as part of a $38 million renaissance there (see “A Gem Worth Fixing,” p. 52, for more).

Speaking about the two reopening resorts, Schmitz remarked, “I actually had the chance to visit both of them throughout the construction season. It’s very inspiring when people put in a tremendous amount of energy into reviving ski areas which are really the lifeblood of their communities.”

In Alaska, SkyTrans Manufacturing fabricated a triple chair for a brand new community ski area called Skeetawk.

Growth in the East. The East Coast actually saw more new installations in 2020 than the last two years, stretching from Florida all the way to Maine. The State of New York committed to replace three aging lifts at Gore Mountain and Whiteface in a joint deal with Leitner-Poma and Skytrac. The Olympic Regional Development Authority also purchased new cabins for its Whiteface gondola from CWA.

Rockies resorts led in the West. Western lifts were, as usual, centered in the Rocky Mountains, with three projects in Colorado, two in Idaho, two at Montana’s Yellowstone Club, and one each in Arizona and Utah.

Among the marquee projects in the Rockies, Leitner-Poma supplied two fixed-grip chairlifts to Arapahoe Basin—a quad and a double. The company has built three new lifts there since 2018. “A-Basin is a really special customer for us,” notes Mauch.

Aspen Skiing Company purchased its first DirectDrive lift, a 2,000-vertical-foot Leitner-Poma six place at Snowmass. It’s designed to accommodate bubbles as an option in the future. Sun Valley debuted a 380-acre expansion dubbed Sunrise, served by a Doppelmayr detachable quad called Broadway.

Supply chains functioned smoothly. Manufacturers found production and installation went relatively smoothly. Quite a few lifts were handed over ahead of schedule, well in advance of first snowfalls.

“On production and logistics, we really saw no interruptions, even for equipment that came from Europe,” says Schmitz, for whom 2020 was her first year leading Doppelmayr USA. “As far as construction, there was a unique set of challenges with local regulations and restrictions. We were really grateful for our customers helping us navigate local requirements and supporting our crews.”

Other news of note. Timberline Lodge, Ore., added the only new ski lift on the West Coast, while Minnesota’s Hyland Hills took that honor for the Midwest. Canadian resorts, which face significant headwinds due to continued border shutdowns, added only four new lifts this year. All of them were fixed-grips.

Building the top terminal of the new Doppelmayr high-speed quad at Timberline Lodge, Ore.

Building the top terminal of the new Doppelmayr high-speed quad at Timberline Lodge, Ore.

T-bars continued to be a small but meaningful chunk of the market, with new installations in Idaho and Vermont. LST, now known as MND Ropeways, completed its third T-bar project in the United States.

Aside from winter resort business, Doppelmayr supplied two foot-passenger gondolas at the Icy Strait Point cruise port in Alaska and Super Bowl-hosting Hard Rock Stadium in Miami.

CONVEYORS TAKE A HIT

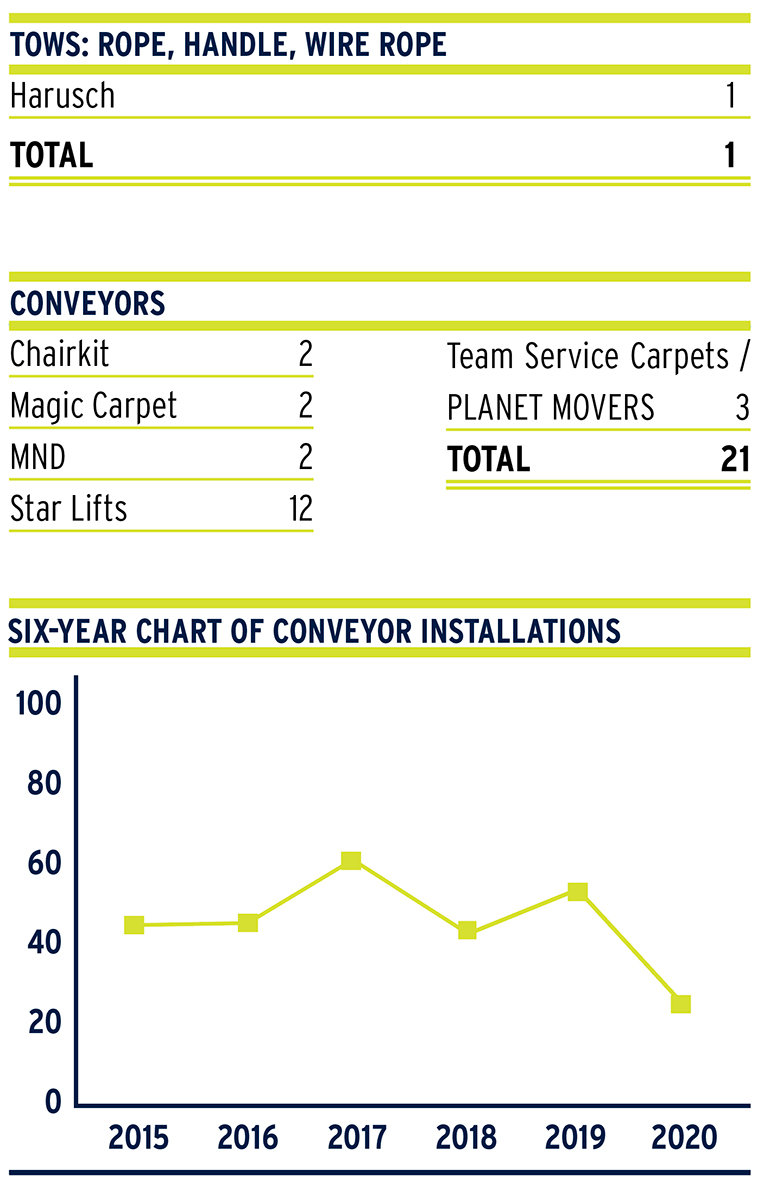

The conveyor business was competitive in 2020, with five players vying for the relatively few projects that went ahead. The total number of conveyors delivered dropped from 53 in 2019 to just 21 in 2020. Star Lifts made the most installations, though its business still fell by two thirds. Similar to the aerial lift side, many orders were canceled or postponed in late March and early April.

Last-minute installs. Star Lifts GM Conor Rowan attributes his successes to anticipating there would be late orders once ski season came into view. He brought lifts over from Europe and stored them until calls came in, some as late as November. Many of those late orders were for shorter lifts at “mom-and-pop ski areas,” says Rowan.

A lot of carpets were added for tubing, with the thought that guests who may not ski or snowboard would still be looking to get outside this winter.

Conveyor at Sky Tavern recreation center, Nev., from Team Service Carpets / PLANET MOVERS.

Conveyor at Sky Tavern recreation center, Nev., from Team Service Carpets / PLANET MOVERS.

Chairkit’s Marc Wood says interest in loading conveyors is strong. Skytrac installed Chairkit conveyors on its two new lift installations in New York.

OPTIMISM AMID UNCERTAINTY

Lift manufacturers see potential in 2021, as new orders hopefully come on top of projects deferred from 2020. “If even just half of what got pulled back last year goes, and you’ve got new ones popping up, we are all going to be at least somewhat busy next year,” notes Skylling at Skytrac, which had already sold three lifts as of late November. “If all of last year’s pulled-back jobs go, we’re going to be really busy.”

Rowan shares Skylling’s optimism: “The demand seems like it’s there, and I think 2021 is going to be really good. My fingers are crossed for a good snow year.”

Others were feeling a bit more measured in early December. “There is still a good level of interest, there are some good conversations and also some first commitments already from customers,” says Doppelmayr’s Schmitz. “We are very excited about [early orders], but there’s still a little bit of uncertainty about next year.”

“I think we’re going to install some lifts next summer,” notes Jay Bristow, general manager for MND America, the only manufacturer offering both conveyors and aerial lifts. “For as many customers that were really impacted and not prepared, there are just as many who are ready to take advantage of low interest rates and easy access to capital.”

From Leitner-Poma’s perspective, “2021 looks really good,” says Mauch. “I think everybody feels like by next ski season, we’re going to be through the bulk of Covid. They want to have a fresh beginning. A lot of people are looking at machinery because of that.”

One ski area that has already announced a new detachable chairlift for 2021 is Holiday Valley, N.Y. Talking about the investment as coronavirus cases were surging in early November, president and general manager Dennis Eshbaugh said, “It gives our customers a great improvement to look forward to, but also reassures our staff that the current Covid situation will eventually be over, and we need to keep looking to the future.”