Editors’ Note

The strong demand that the industry is experiencing should be cause for celebration; this surge of guests is filling the till. However, the pitfalls of popularity have made national headlines. Overcrowding has led to unhappy guests, fueling a narrative that points to a deteriorated guest experience for what is supposed to be a premium product.

A variety of controllable factors have led to this point—the lack of sufficient capacity in various stages of the guest journey chief among them. Consumers will only tolerate so much frustration before they move on. The current revenue windfall may be short lived if nothing is done to address the issue—both perceived and real—of overcrowding.

Where to start? We asked the team at SE Group, experts in helping resorts master plan, for advice on dealing with the industry’s crowding conundrum. — The Editors

The Issue

The heightened demand that ski area operators saw in 2020-21 has carried over into 2021-22. However, many of the mechanisms used to manage volume in 2020-21 were dropped for 2021-22, resulting in overcrowding—heavy traffic, full parking lots, long lines, long waits, etc.—on peak days at many areas. Each of these conditions diminishes the overall guest experience for long-time skiers and new customers alike.

Bottlenecks. Peak days reveal each ski area’s unique limitations, or “bottlenecks.” At some resorts, these constraints present as a lack of parking and long wait times for guest services; at others, lifts lines are excruciatingly long or trails severely congested. Regardless of where the bottlenecks lie, the adverse effects of experiencing peak demand are a disconcerting reality for both operators and guests.

Industrywide, we should be considering the correlation between prevalent peak day overcrowding and stagnant ski participation. Are we discouraging the conversion of beginners into core participants by not delivering the right experience? We are, after all, in the experience business. Are we both failing to meet the expectations of our new customers and failing to keep the passion alive with our faithful customers because our mountains are just too busy?

Mountain Planning 101

To provide context for this capacity conversation, here’s a little “Mountain Planning 101.” These are the fundamentals of mountain planning inherent in any discussion related to creating an optimal resort experience.

Comfortable Carrying Capacity (CCC)

“Design capacity” is the parameter used to establish the acceptable size of a ski area’s primary facilities: ski lifts, ski terrain, guest services, restaurant seats, building space, utilities, parking, etc. Design capacity, commonly expressed as “comfortable carrying capacity,” “skier carrying capacity,” or “skiers at one time,” refers to a level of use that provides a pleasant recreational experience and does not overburden the resort infrastructure. It often reflects around the fifth- to twentieth-busiest day at any resort. Peak-day visitation at most resorts is typically 25 percent higher than the design capacity.

The calculation begins with lift capacity. “Comfortable carrying capacity is fundamentally a supply versus demand calculation, using vertical feet as the units,” says Pete Williams, SE Group director of mountain planning. The calculation of CCC involves comparing the lift system’s vertical transport capacity against the demand for vertical skiing by guests daily. “Accurately calculating the mountain’s CCC is complex and is the single most important factor in the planning and design of a resort, as it is used to balance all other resort capacities, including elements like parking, restaurant seating, base lodge size, and even things like number of ski rental units,” he adds.

Terrain Breakdown

Terrain breakdown considers the distribution of a ski area’s terrain by ability level. It is desirable for a ski area’s available terrain to be capable of accommodating the full range of ability levels reasonably consistent with market demand. While the specifics of a resort’s marketplace vary, beginner/novice skiers and riders typically comprise 20 percent of the market, as do the experts, while intermediates comprise the bulk of the market (60 percent).

A distribution aligned with market demand will reduce crowding, because your visitors will spread across the terrain that appeals to them. However, if an area’s terrain is not aligned with its audience, it may fail to deliver the desired experience and lose market share. For example, areas with a lack of beginner terrain are typically not popular places to learn how to ski, and areas that lack expert terrain don’t attract the diehards. In some cases, terrain distribution deficits can be corrected through expansion projects.

Trail Density

The calculation of resort capacity is based in part on the target number of skiers that can, on average, be accommodated on a typical acre of ski terrain at any one time. Beginner terrain may be denser (25-40 skiers/acre) due to the slower speed of these guests, while expert runs may be less dense (2-10 skiers/acre).

Understanding trail density allows for the creation of a balanced capacity between the uphill capacity of a lift and the downhill capacity of the terrain it serves.

Downhill before uphill. “The first thing we look at when considering a lift upgrade is the downhill capacity of the terrain it serves, and whether there will be a need to establish more terrain to keep the system balanced,” says Williams. “You can’t address one without the other.” If uphill and downhill capacities are balanced, trails will never become overcrowded, as the “supply” is limited by the capacity of the lift, which in turn is based on the amount of required downhill demand.

Utilization Rate

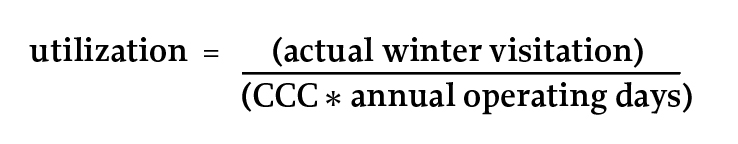

Utilization is one metric to employ when determining the need for expansion. The utilization rate is the percentage of total potential visitation, calculated by measuring actual visitation divided against daily capacity (CCC) and length of season.

Of course, no area is full to capacity every day. Typical utilization at day use areas ranges from 25 percent to 35 percent (note that night skiing increases utilization). At destination areas that have higher weekday visitation, utilization rates are typically higher than 35 percent. While there are no guarantees for future business, high utilization rates and frequent peak days that exceed CCC are good indicators that increases in lift and terrain capacity may well be supported by the market.

Managing Capacity

During the 2020-21 season, Covid-19 forced resorts to manage capacity through reservations, demand pricing that incentivized off-peak use, simplified guest services, and constant communication with the customer. For many, these practices resulted in record-breaking seasonal visitation without record-breaking peak days. This success was aided by pandemic-induced increases in second home residency and flexible remote work schedules, which allowed visitors to shift from weekend to weekday visits.

While some of this flexibility continues, many customers have returned to their pre-pandemic habits—working during the week and playing on the weekends. Similarly, most resorts have dropped the strategies they had deployed to manage capacity in 2020-21. This has led to high demand on peak days coupled with a dearth of strategies to manage capacity, which creates both customer dissatisfaction and operational headaches.

Guest attitudes. To make matters worse, the grateful and forgiving attitude shared by many visitors throughout the 2020-21 season has been replaced with impatience and dissatisfaction in 2021-22. Guests no longer see Covid-19 as a viable excuse for subpar service, despite the staffing shortages exacerbated by the Omicron variant and the high demand many ski areas are experiencing.

Historically, ski areas that regularly exceed their capacity tend to lose market share over time. “I’ve seen this over and over again,” says SE Group principal Chris Cushing. “Areas that have a pronounced imbalance—not enough parking, slow lifts, crowded trails, nowhere to sit at lunch—lose popularity. People get tired of being treated poorly, and they go somewhere else.”

Taking Action

Visitation regulation. Many ski areas recognize the threat posed by customer dissatisfaction. Some are reinstating measures designed to regulate visitation, such as the parking reservation systems implemented at Alta, Utah, and Crystal Mountain, Wash., or the limited ticket sales at Arapahoe Basin, Colo. Having proven their viability last season, these tactics guarantee a consistent standard of experience.

Expansion. In response to continued peak demand, sometimes coupled with feedback from dissatisfied customers, other resorts are planning for expansion.

At Gunstock Mountain Resort, N.H., existing capacity, business volume, and utilization metrics indicate a solid market position and the sustained demand for additional capacity. So, the resort has drafted an ambitious master plan that shows potential for three new areas of lift and terrain expansion. The expansion would proceed on an incremental basis, adding capacity in reaction to a continued favorable response from the market. To provision for the additional visitation each expansion would contribute, the plan also provides for additional guest services and parking so as to maintain a balanced capacity across the resort.

A phased parking lot expansion at Sundance Resort, Utah, is addressing the ski area’s critical shortage of parking capacity. “Sundance was having to turn cars away on peak days,” explains Williams. “That’s a bad experience for everyone, the customer and the operator.”

In concert with the lot expansion, the resort also introduced paid parking to encourage carpooling and maximize its parking capacity, with the aim of better optimizing the parking experience and allowing for greater guest access on peak days.

Lift upgrades. The first phase of a resort-wide master plan for Sundance also includes a new detachable quad, which will provide for additional uphill capacity, as well as a much-needed increase in out-of-base access. “Sundance has an amazing amount of terrain but has always been challenged by a lack of uphill capacity,” says Williams, noting that the new lift will be “a game changer” for the ski area.

“Often, lift upgrades greatly improve the overall balance and distribution of a mountain,” observes Cushing. “Old lifts are often underutilized because they are slow, and as a result, the terrain they access is also underutilized. So, on busy days, lift lines at the faster, more popular lifts get long, and no one’s happy,” he explains.

There is a balancing act in choosing a new lift, though. Any change in uphill capacity must be considered in concert with the downhill capacity of surrounding terrain. “An overcrowded trail is usually a factor of too much uphill capacity,” advises Williams. “If maximizing uphill capacity is a priority, a lift project may require additional terrain construction to keep the system in balance and maintain a pleasant skier experience.”

Detachable lifts maximize capacity and/or minimize ride time, but lower-capacity fixed grips may still be preferable when the goal is to preserve the ski experience by keeping terrain densities low. Fixed grips are also suitable for lower ability level terrain and short lift rides.

Smaller Solutions

While perfection is unrealistic, ski areas should strive to have consistent capacity across lifts, terrain, guest services, and parking. Additional lift and terrain capacity won’t improve the guest experience if visitors can’t find places to park—if customers can’t park, they can’t ski. Similarly, increased lift capacity without simultaneous trail expansion will exacerbate crowding on the slopes, even as it reduces lift lines. New skiers who must endure long rental lines before they can access the slopes are less likely to return.

Strategy is effective, not expensive. While capacity growth is often tied to capital investment, that is not always the case. A year ago, Covid-inspired dining options, rental processes, and ticket pick-up strategies provided additional guest service capacity without building additional space. Further, demand pricing allows some control over peak days and the ebb-and-flow of daily visitation. And traffic can be mitigated without expanding parking capacity through carpool incentives—like priority parking—that increase your average vehicle occupancy (AVO), measures encouraging public transit use, and/or increased resort shuttle operations.

Note that many of these new practices benefit guests and operators alike, allowing resorts to maintain a high-quality guest experience and achieve better balance, without significant capital expense.

Finding Balance

The 2021-22 season has posed unique challenges for ski areas: They are in high demand, and customer expectations have ratcheted up. Though visitors on weekdays largely remain unaffected, guests on holidays and weekends are faced with long lift lines, inadequate facilities, and high volumes of traffic. These all pose threats to a resort’s operation.

Some issues can be alleviated with capacity regulations such as ticket or parking reservations and employing other creative solutions. With sustained demand, many resorts may have an opportunity for expansion. Either way, successful growth in visitation will require careful attention to balancing capacity throughout a ski area so that it may maintain a high-quality guest experience.