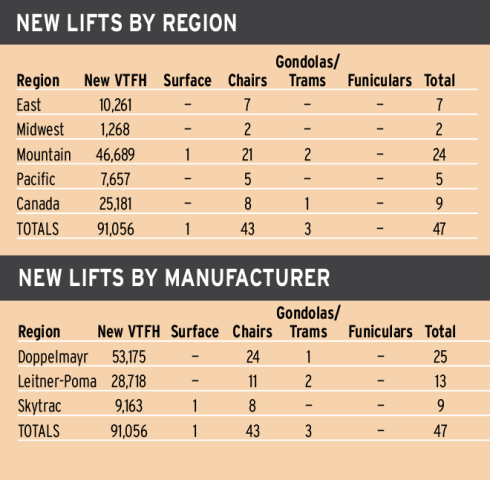

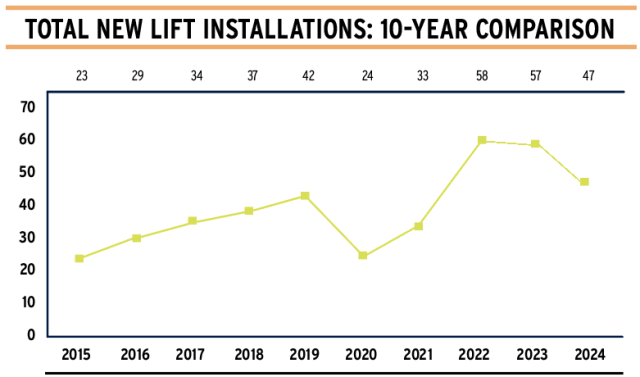

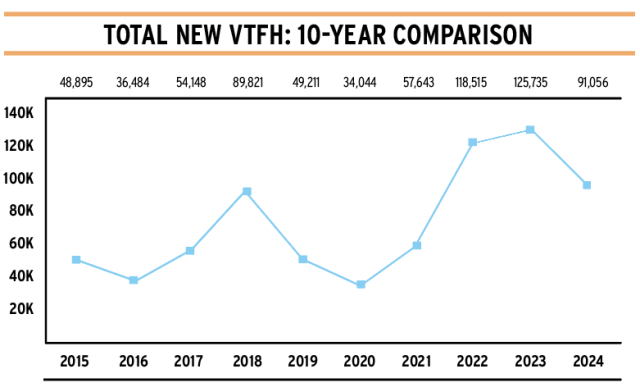

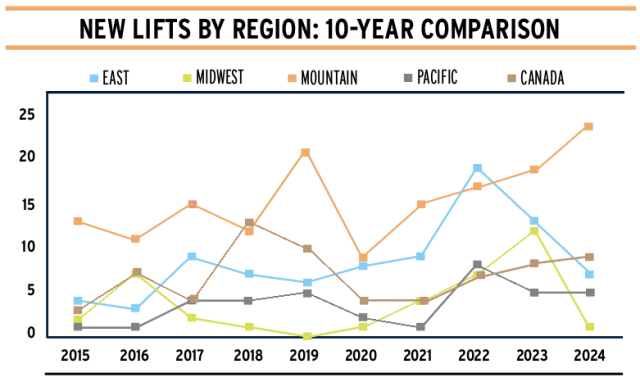

After two gangbuster years of new lift installations at North American ski areas, 2024 was comparatively slower, yet historically strong with 47 new aerial lifts constructed. That’s a 17.5 percent decline from 2023—but still the third most installations in the past 10 years and the fifth most since 2000. Continent-wide, installed vertical transport feet per hour (VTFH) fell nearly 28 percent, signaling the average lift was smaller in 2024 than in the previous two years. However, the 91,056 total VTFH ranks as the third most this century.

While most regions remained relatively consistent, Midwest ski areas installed just two new aerial lifts, down from a dozen a year earlier and perhaps a reflection of one of the region’s worst snow years in decades.

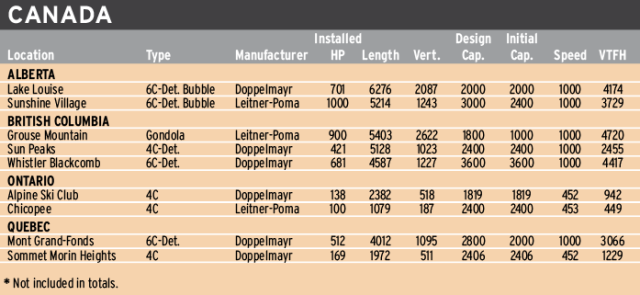

“Certainly, the Midwest went quiet, but otherwise we were pretty busy,” says Leitner-Poma of America director of sales Michael Manley, whose company completed 13 ski area installations, down three from last year. “On the flip side, Western Canada was really a step up for us.” Canada was a bright spot in general, accounting for 27 percent of installed VTFH in 2024, up from just 12 percent in 2023.

“The number of lifts is down a little bit, but it’s mostly a bit of a different product mix,” says Doppelmayr USA president Katharina Schmitz. Her firm delivered five fewer lifts to ski areas in 2024 than 2023, for a total of 25 ski area installations. “If you look at overall construction crew engagement and business volume, [2024 was] pretty comparable to previous years. Slight variation is normal for us.”

Skytrac was the only manufacturer to sell the same number of lifts as last year, with nine installations. “Overall, it was a very solid year,” says Skytrac president Carl Skylling. “We had really good support in particular from smaller- and medium-sized independent operators this year.”

Asked if inflation could be a factor in selling fewer lifts, Manley says it might have been. “We’ve certainly heard from people that they’re concerned about the cost [of new lifts]. We are as well. We’re suffering from the same labor and materials increases as everybody else. It’s gotten a lot more expensive to do construction. It’s gotten a lot more expensive to build things.”

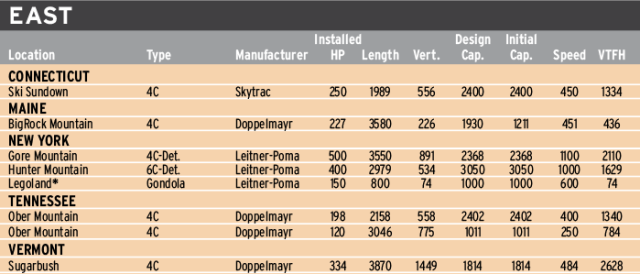

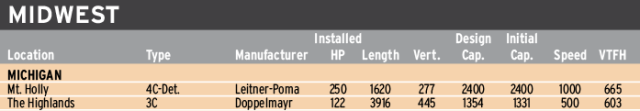

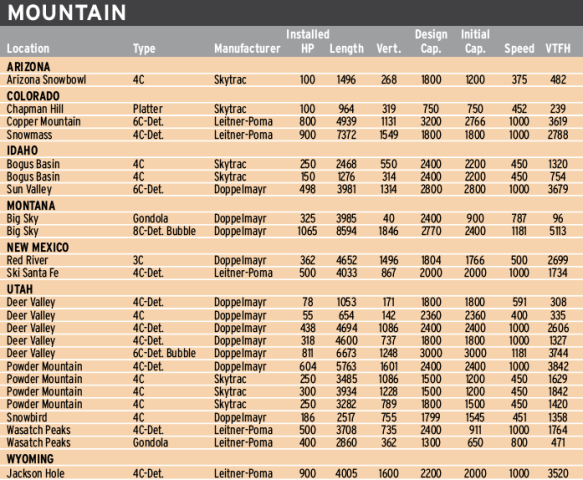

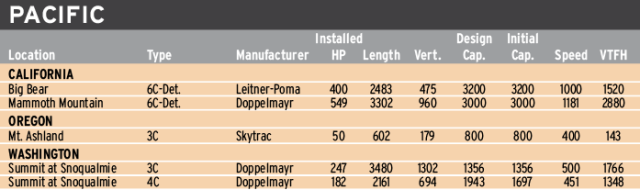

Note: VTFH measures the number of riders who can be transported 1,000 vertical feet in one hour. It is derived by multiplying the vertical rise in feet by the lift capacity per hour and dividing by 1,000.

Note: VTFH measures the number of riders who can be transported 1,000 vertical feet in one hour. It is derived by multiplying the vertical rise in feet by the lift capacity per hour and dividing by 1,000.

These line charts provide a more visual illustration of the 10-year comparisons that are presented as tables in the annual Lift Construction Survey’s online version at saminfo.com, making it easier to see trends.

These line charts provide a more visual illustration of the 10-year comparisons that are presented as tables in the annual Lift Construction Survey’s online version at saminfo.com, making it easier to see trends.

Premium Projects

Large lifts, premium features, and multi-lift projects were some of the highlights of the construction season.

Big for bigger. Doppelmayr installed the largest new lift of the year—Madison 8, a D-Line eight-place bubble at Big Sky Resort, Mont. This was the first time a U.S. resort removed and replaced a six-pack with something even larger. Madison 8 is the longest eight-seater in the world and features automatic station parking, requiring the longest terminals ever used on such a lift. It also features auto-close/locking restraint bars, heated seats, and a four-ring direct drive, similar to other recent installations at Big Sky and other Boyne Resorts properties.

Just a stone’s throw away, developers of the new One&Only Moonlight Basin hotel added their own D-Line lift, a luxe two-way eight-place gondola with heated seats that will connect the property to Big Sky Resort.

Transport gondolas. Across the industry, all four gondolas built in 2024 were people movers as opposed to true ski lifts, bringing skiers and non-skiers alike from point A to point B. Leitner-Poma constructed three of them, including the second-largest new lift of the year by VTFH at Grouse Mountain in British Columbia. The eight-place gondola supplements an existing aerial tramway, providing the sole public access to the ski area. Due to a steep, remote alignment, Leitner-Poma designed several integrated rescue functions and a ring and pinion hydrostatic evacuation drive to minimize the likelihood of a rope evacuation. The workhorse gondola was designed to move up to 1,800 guests per hour up 2,622 vertical feet to Grouse Mountain in less than six minutes.

Comfy seats. Leitner-Poma also completed four detachable chairlifts with premium comfort chairs—at Sunshine Village, Alberta; Wasatch Peaks, Utah; Jackson Hole, Wyo.; and Snowmass, Colo.

“Sunshine’s a particularly interesting project for us as it highlights our premium chairs and many of the premium features we offer: direct drive, heated seats, bubbles,” says Manley. “It has all the higher-end options and looks really sharp.”

The chairs are the first in North America with yellow bubbles, carrying six skiers each. Construction finished on schedule despite early snowfall. The Super Angel Express opened to skiers on Nov. 16.

We’ll take two—or three. Skytrac was able to concentrate its efforts with 10 projects at six ski areas, three of which had multiple lifts installed.

Left to right: Lowering the roof onto the top terminal for the Skytrac Timberline quad at Powder Mountain, Utah; A helicopter flies towers for the Leitner-Poma Sublette quad at Jackson Hole Mountain Resort, Wyo.

Left to right: Lowering the roof onto the top terminal for the Skytrac Timberline quad at Powder Mountain, Utah; A helicopter flies towers for the Leitner-Poma Sublette quad at Jackson Hole Mountain Resort, Wyo.

The Beehive State

One quarter of all new lifts were delivered to one state: Utah. Deer Valley became the first mountain since 1998 to add five aerial lifts in one year as part of a 3,700-acre, 16-lift expansion, set to unfold over multiple years (see “Skiing Double,” p. 77). Two of the new lifts aren’t scheduled to open until 2025-26, but Doppelmayr had the capacity to install them a year early. The highlight of this preview season is Keetley Express, Deer Valley’s first six-pack with bubbles and heated seats. Parallel to and steps from a new hotel, a beginner detachable quad called Hoodoo features auto lowering and locking restraint bars.

Multi-team projects. Due to the project’s scope, Alterra and several subcontractors completed civil construction while Doppelmayr assembled the Keetley six-pack and two quads. Highlander Lift Services & Construction installed two others simultaneously.

“For some of the bigger projects we are seeing more clients take on civil works,” says Schmitz. “There are often benefits in doing that as they often have other infrastructure projects happening at the same time, perhaps other concrete work in the same area.” Work will continue throughout 2025 as Deer Valley plans to construct a two-stage gondola and several more chairlifts.

Elsewhere in Utah, Powder Mountain split a four-lift order between Skytrac and Doppelmayr. Two quad chairs provide access to former hike-to terrain and two replace older equipment. “They are great lifts with great skiing,” notes Skylling, whose company built three of the four. “They were all pretty substantial. They have full APUs, full evacuation engines and they were just done right.”

Nearby, private Wasatch Peaks Ranch added a gondola and detachable quad from Leitner-Poma while Snowbird added a Doppelmayr fixed-grip quad. Including conveyors, a whopping 18 new lifts were installed in Utah in 2024.

Manufacturing expansions. With business booming, both aerial lift manufacturers are investing in the state. Sister firms Skytrac and Leitner-Poma of America christened a shared 130,000-square-foot plant in Tooele last summer, replacing a smaller, leased space in Salt Lake City during the busy construction season.

“We had a pretty tight timeline to get out of our old place,” says Skylling. “Our contractor did an amazing job getting us in. We were able to move our production in phases and plan which machines to move when. We were able to keep production rolling and finish up the year on schedule.” Leitner-Poma plans to move production of towers and line equipment to the Utah facility and add a parts warehouse as its installed base grows nearby.

Just down Interstate 80, Doppelmayr USA is planning a major expansion of its longtime Salt Lake headquarters. Expected to break ground in early 2025, the project will increase domestic production capacity and reduce the company’s reliance on cross-ocean shipping. “We are planning on bringing additional production lines into the new facility,” says Schmitz. “That’s mainly business we are moving from Europe to the U.S. for North American projects.”

There’s no sign of any slowdown in the Beehive State with projects in the pipeline at many Utah mountains and the Winter Olympics returning in 2034. “There’s a lot of work in Utah,” says Manley, who has projects lined up at Park City and Snowbasin for 2025. “We’re working on a few others,” he adds.

Schmitz shared similar sentiments. “Looking ahead to next year, there is a lot of Utah business,” she says. “There are a lot of upgrades planned but also big projects like Deer Valley and Wasatch Peaks that are new ski areas or portions of new ski areas. Those don’t happen often.”

Installing towers for the new Doppelmayr Interconnect triple at The Highlands, Mich.

Installing towers for the new Doppelmayr Interconnect triple at The Highlands, Mich.

Simpler Lifts Carry On

In a high-inflation, high-interest-rate environment, many operators turned to fixed-grip chairlifts as economical people movers. Resorts installed 21 new fixed-grip triples and quads in 2024, nearly half of the total mix. Roughly 40 percent of those feature loading conveyors, designed to reduce mis-loads and increase throughput.

“The industry went through this phase of detachable, detachable, detachable, but a lot of people have realized that fixed grips are a very efficient way to deliver people to the top of the mountain,” says Skylling at Skytrac, which installs exclusively fixed-grip lifts. “They’ve really come back into their own.”

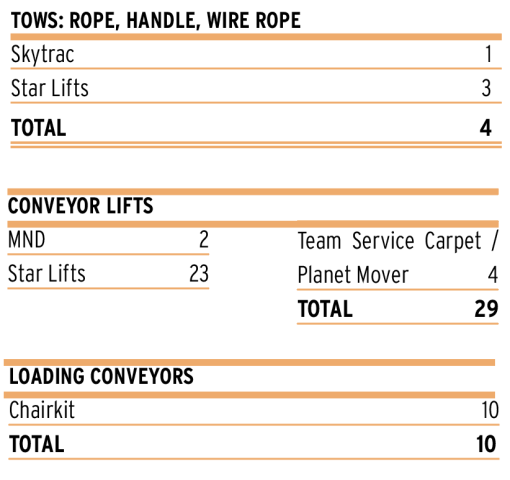

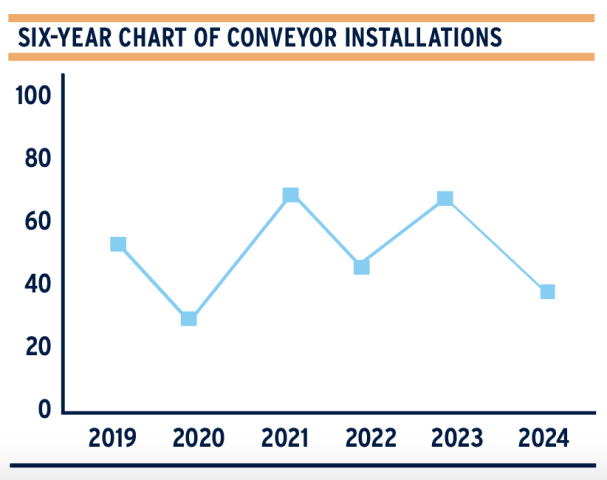

Surface lifts level out. While aerial lift manufacturers have stayed busy post-Covid, the conveyor and tow business was down about 34 percent year-over-year. SunKid remained the market leader, installing 26 new lifts through its U.S. subsidiary Star Lifts. “The Covid boom is over, but the lack of snow in the East and in the Midwest didn’t help us either,” says Star Lifts USA president Conor Rowan. “When you look back at pre-Covid numbers, we’re right about where we were. This is back to normal.”

Despite selling fewer lifts, he was upbeat about one thing: this is the first year SunKid delivered all latest-generation Type N conveyors in the North American market. Many of them went to independent ski areas and fewer to large conglomerates. “Mom-and-pop ski areas were 90 percent of our sales this year,” says Rowan. “A lot of new customers that had not purchased any product from us before.”

MND Group supplied two conveyor lifts this year, and is in the process of testing a new line of detachable ropeways called Orizon that it plans to introduce to the North American market.

Of the four Team Service Carpets/Planet Movers installations, two were built for a municipal tubing and learn-to ski and ride operation in Salt Lake City.

Both Partek and Magic Carpet Ski Lifts reported no new installations in 2024 and have exited the new lift market, though they’ll continue supporting existing equipment. That leaves just a handful of firms selling lifts in North America.

Left to right: Star Lifts SunKid conveyor with gallery at Belleayre Mountain, NY.; Team Service Carpet/Planet Mover installed a conveyor at Gateway Parks, Eaglewood, Utah; MND conveyor lift installation at Christmas Mountain Village, Wis.

Left to right: Star Lifts SunKid conveyor with gallery at Belleayre Mountain, NY.; Team Service Carpet/Planet Mover installed a conveyor at Gateway Parks, Eaglewood, Utah; MND conveyor lift installation at Christmas Mountain Village, Wis.

Holding Steady

Asked about their outlook for the new year, executives remain optimistic. “It’s an interesting outlook with some very large detachable projects in the East and West,” says Schmitz. “That’s a solid foundation, but there certainly still is some capacity for Doppelmayr and the industry for additional lift projects.”

On the conveyor and tow side, Rowan says he notched a handful of sales already as of November, early in the game for smaller lifts.

For fixed-grip chairlifts, Skytrac’s Skylling says, “We’re going to have five or six projects on the books going into the new year, which is a great start for us. We’re pacing to at least be where we have been the last couple years, if not better.”

He notes that inflation has really slowed down, which should help both suppliers and customers. “We don’t see that same level of pressure on the producer price index. Hopefully, it’s no more than 3 percent a year, which almost gets back to normal.”

Skylling’s colleague at Leitner-Poma of America concurred with the holding steady mantra. “We’re feeling that next year will probably be similar to this year,” says Manley. “There’s a lot of interest in 2026 already. People seem to be planning ahead, which is certainly welcome.”