DOWN IN THE COUNTY

For some, this season mirrored last: a strong finish balanced out a bumpy start. For others, the winter came in like a mouse and scurried out like one too, leaving few if any signs it had been there at all.

What impact did this have on outcomes for the season? We wanted to know, so we asked.

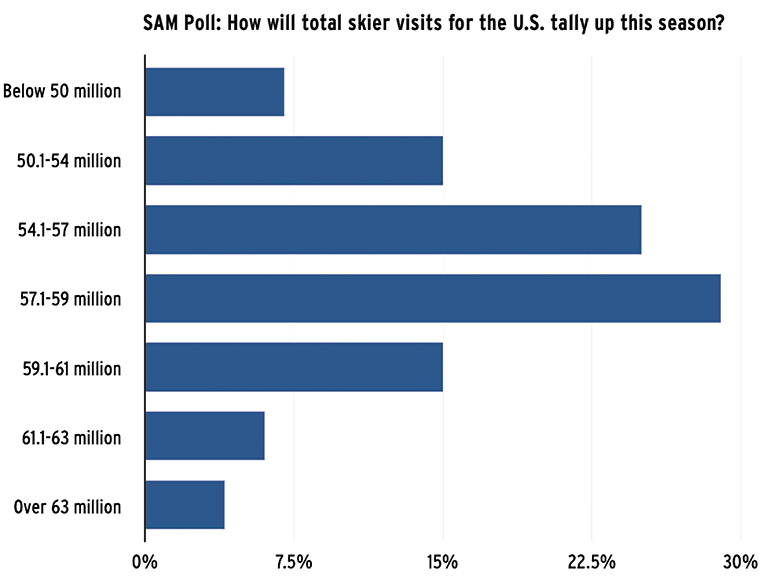

In an informal poll conducted in April, 130 respondents shared their estimates for season end results. Note: there’s no scientific methodology here. This was a “give us your best guess” kind of deal. The picture it paints of attitudes and numbers is nonetheless interesting.

Three out of five (61 percent) respondents expected skier visits at their resort to be down compared to 2022-23. Conversely, 57 percent of respondents anticipated their revenue would be up or flat year-over-year. The more favorable portrait of revenue could be an outcome of pricing strategies, pass sales, ancillary business, or any combination of these.

The sense that visits were down could be skewed by our sample pool (again, highly unscientific method), but it is also reflected in respondents’ estimates for total U.S. skier visits.

The optimistic lot was small—only 4 percent believed skier visits would top 63 million. Seven percent estimated less than 50 million—which would be a dramatic decline from last season’s record breaking 65.4 million U.S. skier visits. The largest portion of respondents (29 percent) estimated somewhere between 57.1 and 59 million skier visits.

Sentiment isn’t science, of course. In this same SAM poll last year, only 16 percent of respondents thought that 2022-23 would top 2021-22’s record of nearly 61 million skier visits, and we all know how that turned out.

That said, most of the visitation gains in 2022-23 happened in the Rockies and other western regions where prolific snow fell all season long. Snow was not nearly as frequent or abundant this season out West—although conditions were more favorable than fickle, especially when compared with the Midwest and Mid-Atlantic.

Respondents illustrated the varied experiences this winter when asked to sum up the season:

- “Challenging to operate with marginal conditions for 75 percent of our operating days.”

- “Average snow, better than average turnout.”

- “A struggle from start to finish.”

- “Great snow meant great business.”

- “Low snow, low visits.”

- “Most challenging weather in our recent history, but our teams are resilient.”

- “Could’ve been worse.”

- “Our second-best ever.”

- “Terrible first half, incredible second half.”

- “The demand is there... the timing of the weather was not.”

Some final thoughts: Several ski areas reported playing catch up from a difficult start to the season. “Missing Christmas lingered into the full year,” said one respondent.

And some expressed concern that this season’s difficult conditions were already impacting next season’s pass sales: “Anecdotally, we’re hearing people say that they didn’t ski that much this winter and they are not sure a season pass is worth the investment.”

Generally, in this industry, snow = skiers, but there were some encouraging reminders in the poll that powder isn’t the only draw.

One respondent in the PNW noted that their resort had a “great” season, “not a ton of powder days, but amazing snow conditions, good numbers and happy skiers.” Another in the Southeast (not be confused with the Mid-Atlantic), where snowfall was below average this winter, said, “We had a great year. Our clientele is primarily beginner skiers.”

So, we’ll see how the overall numbers shake out. Whether your ski area got lots of snow or none at all, one Northeast operator spoke for everyone in saying: “Mother Nature was a tough boss!”

THE LONGEST PRESEASON EVER

By Marsha Hovey, Marketing Director, Trollhaugen Outdoor Recreation Area, Wis.

By the time February rolled around at Trollhaugen, our unofficial internal tagline for the winter was, “The Longest Preseason ever.” What started in December as a little joke between Midwest industry folk while we waited for viable snowmaking temps became less funny as the days passed and the weather refused to change course.

According to the Southeast Regional Climate Center, the average daily temperature for Minneapolis—our neighboring big city, which typically sees similar weather to the St. Croix River Valley of Wisconsin, where Trollhaugen is situated—was 10.7 degrees above normal this winter, and the region experienced a record 23 straight days of above-freezing temperatures. The trouble didn’t end there. As of Feb. 13, Minneapolis had its lowest snow total on record. Ice cover for the Great Lakes was the lowest on record. Wisconsin even saw its first ever February tornado. Yikes.

It doesn’t take a climate scientist to deduce that snowmaking weather was almost non-existent during the most critical period of our season. And when we were able to make snow, we had impending warm days and wet weather staring us down. It was exhausting. And revealing.

We discovered a startling truth during our snowless months about the customers we thought we knew so well. It turns out, they aren’t as educated about how this all works as we thought.

Fake snow. As the phones rang with questions and social media messages rolled in, something we heard over and over was, “Are the conditions any good? Because I can tell the difference between machine made snow and real snow,” or better yet, “Is it worth coming? Because I don’t like skiing on fake snow.”

Fake snow, fake snow, fake snow, on repeat.

Now, it’s frowned upon to grab someone by the shoulders and shake them where they stand, but let it be known, the urge was there. It’s like nothing we said or did could wipe away this notion that our entirely real—and sometimes, better than the stuff that falls from the sky—surface was in fact “fake snow.”

We showed our customers photos and videos of our snow and tirelessly touted our snowmakers and snowmaking system. We presented pleasing visuals of fresh corduroy and the big machines that make it happen. We delivered real-time photos and videos to social media of real people physically enjoying the fruits of our labor on skis and snowboards, each and every day. And still, disbelief.

Our Midwest community could not fathom that we had snow (good snow!) when they did not, because outside their office windows and front doors was a sea of never ending green … the entire winter.

Customer psychology. Many places in North America are used to this phenomenon. In areas of California, Oregon, and Washington, you grow up knowing you have to travel to the “mountain” to get the snow. It might not be in your yard, but if you drive in that direction over there, you can find snow and ski your heart out.

It was something we had never experienced before, though. Because in the Midwest, it’s usually snowy and cold all winter. Snow isn’t just part of the climate, it’s part of the culture. Winter is a way of life. When the normal blanket of snow wasn’t visible and the frigid temps never showed, it seems Midwesterners couldn’t comprehend a world in which a quality product for skiing and snowboarding existed at a ski area down the road. Just not possible.

Of course, our dedicated customers enjoyed the slopes as normal. Our die-hard seniors were there every morning for first chair. Our race teams arrived by bus each night. Our terrain park community lapped the rope tows ’til close.

Who was missing? The casual weekenders. The holiday break families. The college friends looking for a weeknight activity. In essence, the daily lift ticket and rental and lesson purchasers were off riding bikes, doing yard work, and enjoying brunch on a patio somewhere, adapting to the never-ending autumn like a bird that missed the memo to migrate.

Winter may be a way of life here, but we’ve been reliant on machine made snow for decades. It’s not a secret, and yet our customers’ reactions made it feel like we had kept this information from them. They’ve slid on “fake snow” their entire lives, loving it enough to keep coming back. Apparently, they never realized it.

Collective effort. Mother Nature could very well continue with her seasonal whiplash, and we could find ourselves repeating the woes of the Longest Preseason Ever next season and beyond. If that is the case, we as a collective region of ski areas need to be prepared to work together to reeducate an entire culture if we want Midwesterners to leave their green yards behind in search of the snow we know how to make so well.

LETTER TO THE EDITORS

To the Editors:

For perspective, let me first tell you what kind of customer I am. I’m a third-generation alpine skier. This is season 59 for me; I started just before my fifth birthday. Skiing is in my blood and skiing takes on an almost spiritual level of importance for me. I’m not “rich,” but I do have more disposable income and fewer financial liabilities than most.

In other words, I’m about as devoted to this sport as customers get and can afford to participate without financial hardship. And yet you—the areas whose ticket prices have approached $200 to as much as $350 per day—have crossed even my line. Even with weekday rates or multi-day purchases through Epic and Ikon, ticket rates work out on the order of $15 per run. And that’s one or two people skiing hard with few breaks, forget family groups. It’s way out of proportion by any measure and makes thinking customers feel that they’re being played for fools. It kills the joy.

Yes, you are getting these prices; there are still large numbers of wealthy people from big metropolitan areas who follow the herd, not pausing long enough to notice. At least for now.

Realistically, alpine skiing has always been a sport for the upper half, but the line has moved far above that percentile. New people who consider giving this sport a try see these rates, the cost of the lessons and equipment, the hassles and long drives, and understandably view the entire thing as a stupidity. It’s a total non-starter for a large family.

Sooner or later, this direction will either have to back off or fail. I might suggest to the industry as a whole—resorts, equipment makers; lift, snowmaking, and groomer manufacturers—consider taking it down a notch in sophistication to preserve the sport. We used to have a great time with slower surface lifts and fixed-grip chairs, less expensive skis and boots that required a bit more athleticism, and tickets that only cost tens of dollars per day. We’d go out every weekend there was enough snow to ski on.

As for me, I’ve been looking for the more modest resorts and only going out when the conditions are very good. As far as I’m concerned, Mammoth, Heavenly, and Palisades—areas within a day’s drive that I used to frequent—have ceased to exist.

I’m not saying to go totally backwards, of course, but I’m pretty sure that the profitability, future outlook, and tons-of-enjoyment-per-season curves might meet at an optimum point that has been overshot.

Jesse Brumberger

Tehachapi, Calif.Ed. Note: Mr. Brumberger is a longtime SAM reader. He sent this letter in mid-February. We published another letter to the editors from Mr. Brumberger back in November 2020 with suggestions for how ski areas could mitigate Covid transmission while operating.

He seems like a smart guy.

Relating to his complaint about lift ticket prices, we were curious how much lift ticket prices have risen in the past 10 years relative to inflation, operating expenses, and the like.

According to the Kottke report, the average weekend adult ticket price in 2022-23 was $182, a little more than double the $90 average in 2013-14—that’s a 102 percent increase. In those 10 years, the national cumulative price change (i.e., inflation) was 30 percent.

According to the “2022-23 Economic Analysis of U.S. Ski Areas,” operating expenses have risen 63.6 percent in the 10 years from 2013-14 to 2022-23. However, overall expenses are down on a percent of overall revenue basis during that same 10-year span (as in, revenue has grown quicker than expenses).

So, average lift ticket prices are outpacing operating expenses by roughly 59 percent, and have risen more than triple the rate of inflation in the past 10 years. During that same time, profit before tax rose a whopping 519.7 percent.

While the high cost of a daily ticket has presumably strengthened early season pass sales, we may end up paying a steeper price for this shift in consumer behavior down the road if we close out casual participants, beginners, and families—as Mr. Brumberger suggests we may already have.

YOU SHOULD KNOW ABOUT THE NORTH CAROLINA SKI INDUSTRY

By Kimberley Jochl, Vice President, Sugar Mountain Resort, N.C.; Board Chair, North Carolina Ski Areas Association

Since 1961, when Cataloochee ski area first opened, snow lovers have enjoyed lift-served skiing in North Carolina. Today, the Tar Heel State’s ski industry infuses more than $244 million in overall economic value into the state and employs more than 1,700 people during the winter. North Carolina’s six little ski areas—with a cumulative 85 trails, 34 lifts, roughly 400 skiable acres, and vertical drops ranging between 200 feet to 1,200 feet—pack a pretty strong punch.

When I rattle off these and other stats about North Carolina skiing, most people look at me with an angled smile and equivocal eyes and reply with, “What? Really?”

At NSAA conventions, folks see North Carolina on my badge and ask, “There’s skiing in North Carolina?” Who could blame them? After all, geographically, the North Carolina mountains exist on the same latitude as North Africa and most people don’t associate mountains, cold weather, or snow with any southern state. North Carolina’s famous for basketball, beaches, BBQ, and the Wright Brothers.

Advantage: population. But a state that draws 700,000-800,000 skier visits each season, 30 percent of whom are first-timers or beginners that rent everything from outerwear to equipment, is nothing to sneeze at. From a market standpoint, our location is an advantage. The Southeast is one of the fastest growing regions in the country and is home to three of the 10 most populated states in the U.S. Much of this massive population is within a day’s drive of North Carolina skiing. And Florida and Georgia have some of the largest and most active ski clubs in the country.

Advantage: elevation. Many of the tallest mountains in the Eastern United States are in North Carolina, including Mount Mitchell, the East’s highest peak at 6,684 feet. Five of the six ski areas in the state have summit elevations of at least 4,000 feet: Beech Mountain (5,506 feet), Cataloochee Ski Area (5,400 feet), Sugar Mountain (5,300 feet), Hatley Pointe (4,700 feet), and Appalachian Ski Mountain (4,000 feet). Of these five, Appalachian has the lowest base area at 3,635 feet, which is higher than the summits of most ski areas in the Northeast. Sapphire Valley Ski Area, the state’s smallest, located in the southwest corner, reaches 3,400 feet—still not short by East Coast standards.

These elevations provide much cooler microclimates than the valleys below.

Advantage: snowmaking. In North Carolina, snowmaking is king—we don’t exist without it. Snowmaking covers 100 percent of our ski areas’ developed terrain. These powerful systems are designed to take advantage of short snowmaking windows. In some cases, a ski area can go from closed to 100 percent open in less than 24 hours—but it’s an ongoing process throughout the winter.

At Sugar Mountain, some years snowmaking can reach 1,500 hours at a cost of $2,000 per hour. Mind boggling investment, constant and impeccable maintenance, and a crew that believes snowmaking is a craft, an art, and a science, led by decades of experience, is the only way to survive. And even then, two consecutive days of pounding rain at 50 degrees can wipe out the entire ski area, bringing the operation to a screeching halt.

So, sometimes North Carolina operators start all over, and are still able to pull out a season for the record books.

Advantage: resilience. Take for example the results of this past season. Torrential rains accompanied by warm temperatures plagued the southern Appalachians more than normal and snowfall measured about 50 inches, well below the state’s 78-inch annual average. A late start left us all with a shorter than normal season.

Appalachian Ski Mountain recorded 106 skier days, 15 less than last season and stomached 26 days of rain, five on Saturdays. Sugar Mountain Resort’s skier days fell from 136 last year to 118 this season.

Despite these challenges, Cataloochee experienced a 5 percent increase in skier visits and an 11 percent growth in gross revenue over the previous season. Sugar Mountain Resort’s skier visits held steady while gross revenue set a record, up 4 percent over last season. Appalachian Ski Mountain revved up season pass sales and held firm in gross revenue but took an 8 percent hit in skier visits. With nearly 800 snowmaking hours this season and 107 skier days, Beech Mountain Resort leads the pack with skier visits up 10 percent resulting in a 20 percent increase in gross revenue.

And behind it all, are the people. In the era of mega ski resorts, all six North Carolina ski areas remain privately owned. Each of those owners looks forward every day to a hands-on approach.

SUPPLIER NEWS

Yolanda Foose was named SVP of customer success and business development for ASPENWARE.

Kevin Moudy is the new vice president of after sales and services at KÄSSBOHRER ALL TERRAIN VEHICLES.

PEOPLE

Jace Wirth was hired as general manager of Cannon Mountain, N.H. … The Resorts Companies, Inc., owner of Massanutten Resort and Wilderness Presidential Resort, Va., named Lee Lorimer as its new corporate director of human resources.

Mt. Rose Ski Tahoe, Nev., promoted Jake Brown to director of mountain operations and Mike Ferrari to director of risk management.

Shaydar Edelmann was appointed GM and VP of Heavenly Mountain, Calif. He succeeds Tom Fortune, who is retiring after 45 years in the industry.

Courtney Goldstein was named executive vice president and chief marketing officer for Vail Resorts.

NZSki appointed Steve Hall as ski area manager of The Remarkables in Queenstown, New Zealand. He succeeds Ross Lawrence, who retired in April after 40 years in the industry.

AWARDS

In March, NSAA received the Ceres MVP Award for Climate Advocacy.