SAM Magazine—Winter Park, Colo., June 14, 2023—Lodging properties at western mountain destinations are facing a more price-sensitive customer this summer, according to the latest Market Briefing from DestiMetrics, part of the business intelligence division of Inntopia. Data collected through May 31 from 17 mountain destinations in seven states revealed that consumers have been reluctant to book stays at higher prices. Property managers have lowered rates, which is starting to fill in some of the occupancy deficits, though summer occupancy still remains well below last year’s record level.

Data collected through May 31 from 17 mountain destinations in seven states revealed that consumers have been reluctant to book stays at higher prices. Property managers have lowered rates, which is starting to fill in some of the occupancy deficits, though summer occupancy still remains well below last year’s record level.

Economic worries are contributing to consumer caution about booking, according to the Briefing. Consumer sentiment has been dropping in recent months, and the unemployment rate has begun to tick upward. Inflation, while moderating, remains a concern, too.

Actual occupancy in May was down 1.4 percent compared to the prior year and the average daily rate (ADR) was up a slight 2.1 percent. When compared to four years ago at this time, occupancy for the month was down a sharp 15.2 percent, but ADR was up 35.6 percent.

For the full summer as of May 31, on-the-books occupancy for May through October was down 5 percent compared to last summer, with declines in all months except October. ADR is up only 0.9 percent with small gains through July; rates in August and September are down slightly.

The contrast with four years ago is striking. Occupancy for the full six months of summer as of May 31 was down 8.4 percent, while ADR was up 41.9 percent.

“The long-term impact of inflation and high prices has been producing softer bookings and shorter stays for some time,” explained Tom Foley, senior vice president of business intelligence for Inntopia. “Those changing business conditions require a shift in pricing and marketing strategies.”

Foley further reported that lodging properties are making that shift by bringing rate growth down to near flat year-ove-year. “Consumers have responded and we are seeing both occupancy and revenue improving appreciably ... although both remain below last year,” he said.

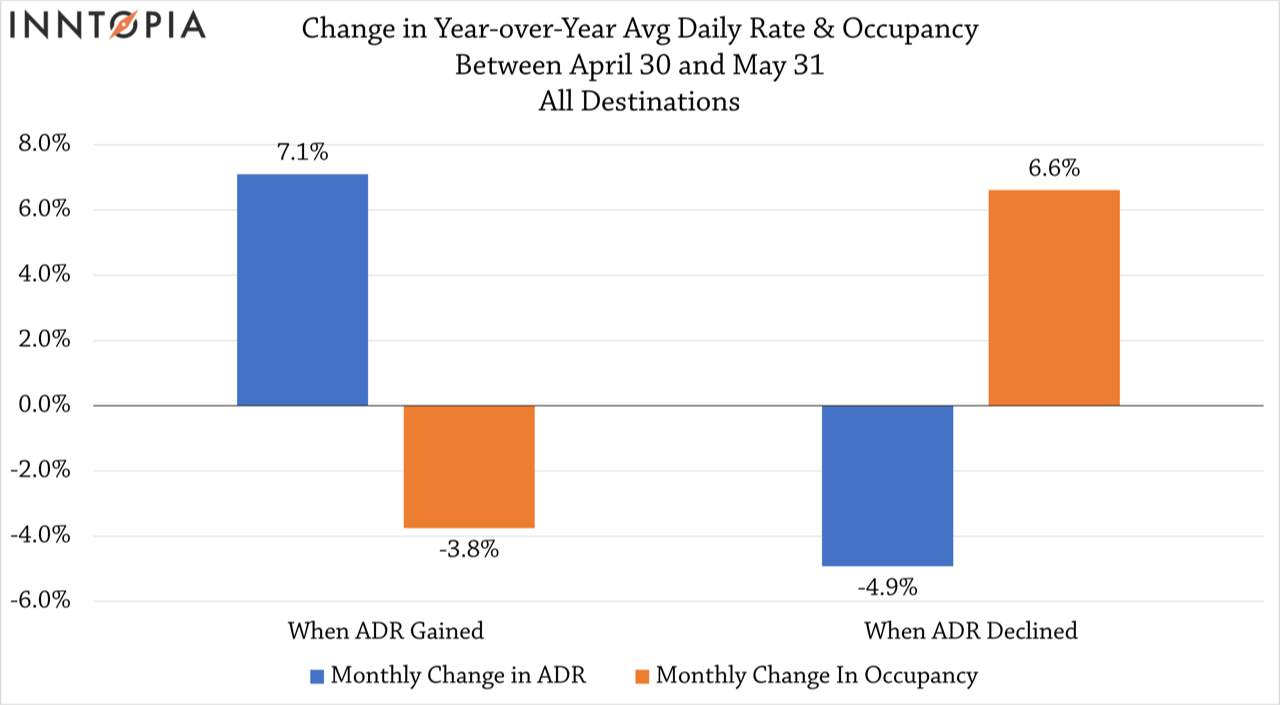

Not all markets are showing rate declines, and the contrasts with those markets where rates are dropping are instructive. In destinations where year-over-year rates rose, gaining an average of 7.1 percentage points during May, occupancy dropped by 3.8 percentage points. But for properties where rates dipped, declining an average of 4.9 percentage points, there was a strong 6.6 percentage point improvement in summer occupancy.

As further evidence that lower rates are attracting visitors, Foley points out that ADR has been dropping each month since February, and occupancy has been rising in response. In May, for example, a drop of 1.9 percent in ADR triggered a 4.4 percent increase in room nights booked.

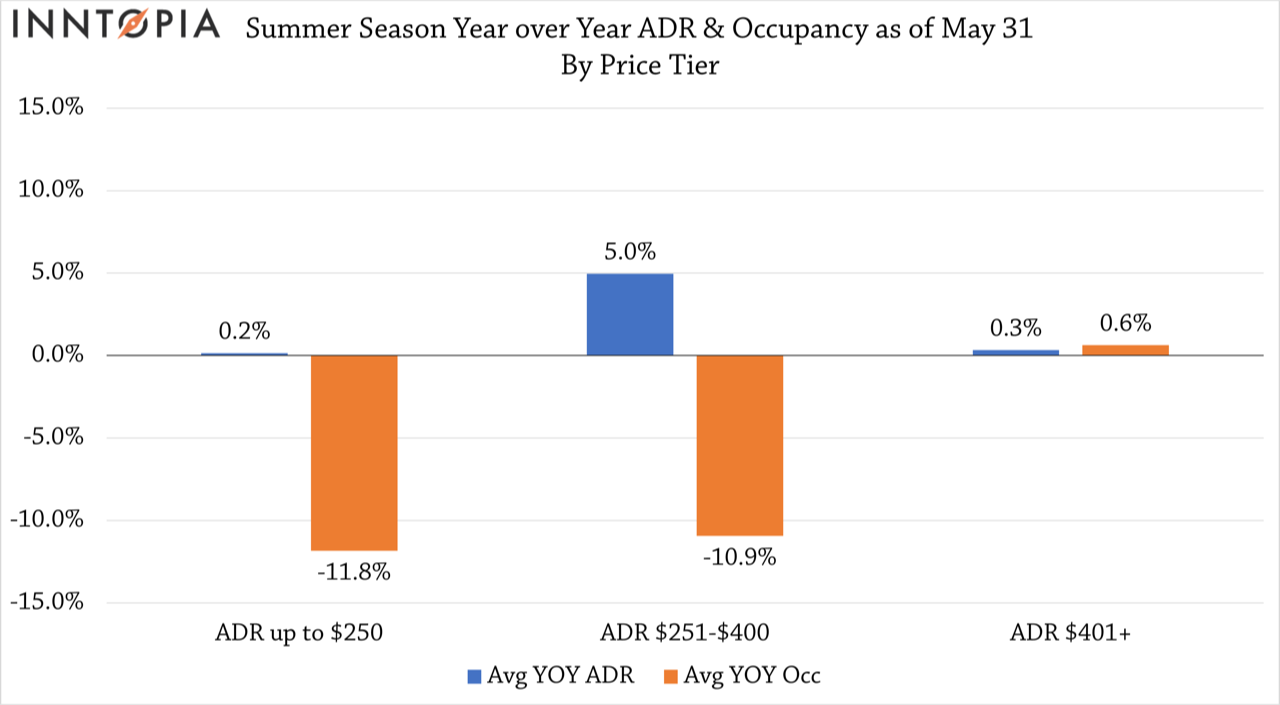

In an indication of price sensitivity, the Briefing reported that properties with an ADR of $250 or less were essentially flat on ADR, but down 11.8 percent in occupancy among their price-sensitive consumers. Properties with an ADR between $251 and $400 were charging 5 percent more for summer bookings, but occupancy was down 10.9 percent. Properties charging more than $401/night have been mostly flat on rate and occupancy.

Still, Foley pointed out that “conditions are better now than they were just 30 days ago and much better than three months ago." He added, "Mixed economic conditions and broadening competition from cruise and urban travel are increasing the challenge for mountain destinations. Lodging properties are now grappling with something we’ve been expecting for more than 18 months—a correction in the massive growth of rates.”